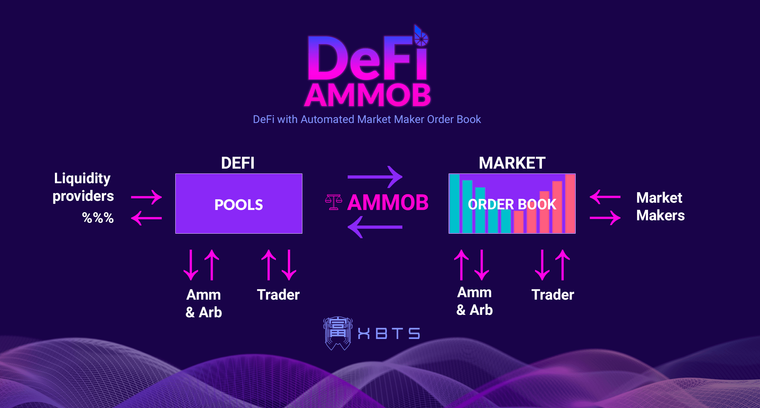

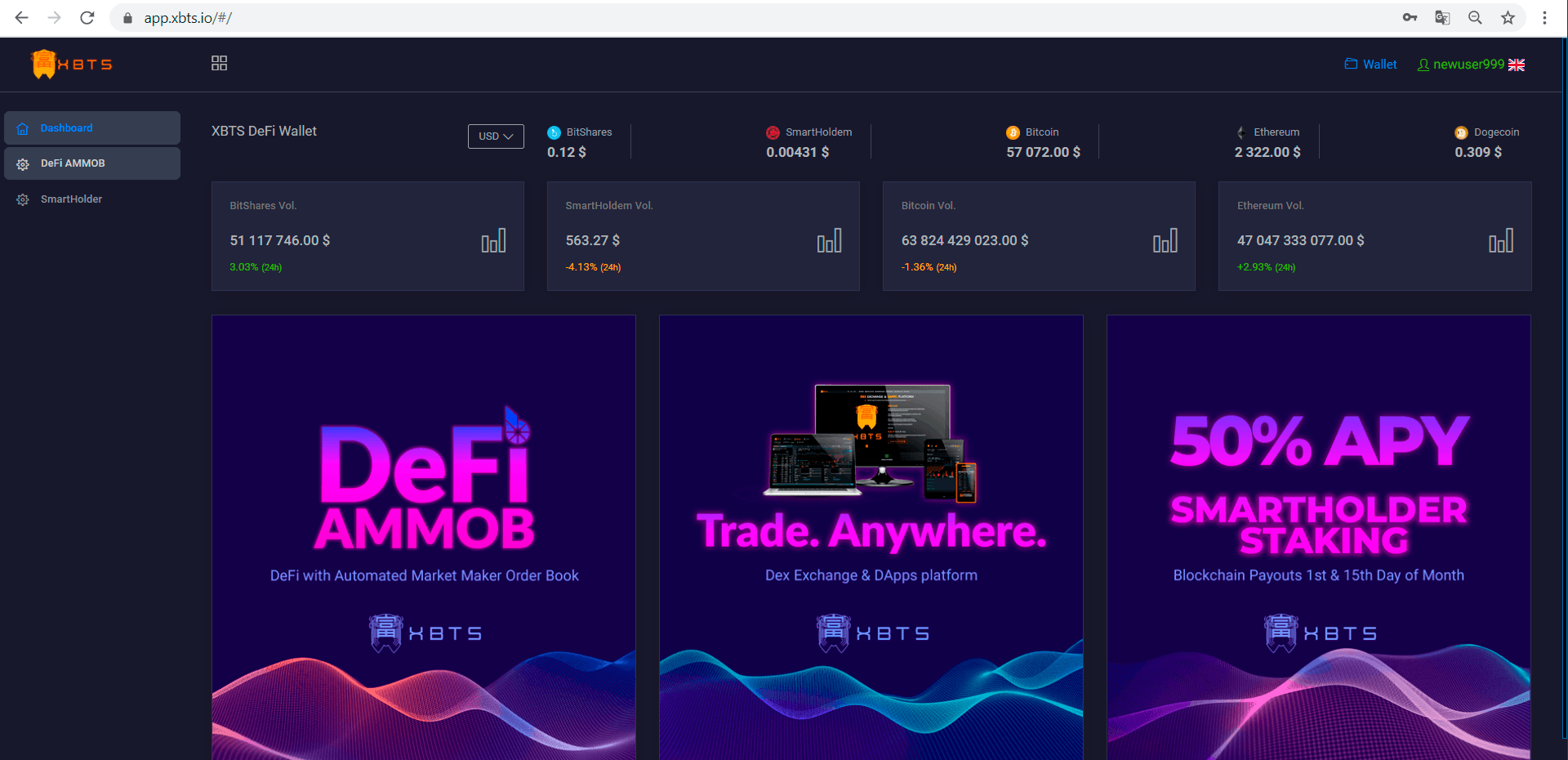

DeFi AMMOB - DeFi with Automated Market Maker Order Book

-

Next Generation DeFi platform - DeFi AMMOB

https://app.xbts.io

Our mission is to make DeFi simpler, more accessible & across-the-board

Best investment opportunities with XBTS DeFi AMMOB Liquidity Aggregator.

XBTS DEX https://xbts.io is a BitShares-based decentralized exchange and an entry point into the volumes of decentralized markets.

XBTS DeFi AMMOB platform is an Automated Market Maker Order Book protocol designed for swapping between cryptocurrencies with low fees and limited slippage.

-

Liquidity protocols of XBTS DeFi AMMOBS platform allow anyone to become a Market Maker, Add their assets to several different liquidity pools and Earn fees on many different market pairs.

-

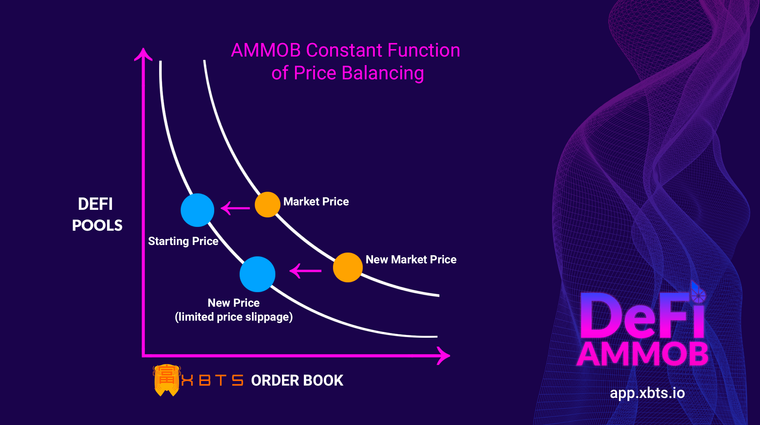

Price quotes on an DeFi are created through complex and scalible pricing algorithm AMMOB which does take into account any external information regarding of the world average price of asset and trading spread on the BitShares blockchain.

-

Liquidity providers that pool their capital in an XBTS Defi Platform make markets by always trading against the prices set by the AMMOB's pricing algorithm, essentially acting as Informed Market Makers.

XBTS Defi AMMOB platform allows its users to both supply liquidity to earn passive income or exchange between various assets.

Liquidity pools work in conjunction with the order books of the XBTS decentralized exchange.

Pools are financed on-chain for both assets of a trading pair and provide additional liquidity for traders and market makers on the exchange.Liquidity is provided by Users who receive passive income from their deposit through trading commissions based on the percentage of the liquidity pool they provide.

The arbitrageurs always pay liquidity providers (investors) of the DeFi AMMOBs! The Arbitrageurs can not change the token allocation of the liquidity pools to correct price quotes towards the market price.

- Thanks to the high speed BitShares blockchain, XBTS DeFi AMMOB is becoming a full-fledged alternative to traditional finance - lightning fast order books and price balancing algorithms make DeFi a desirable, safe and profitable tool.

DeFi AMMOB is a full cycle DeFi Ecosystem

What Is a Liquidity Provider?

A liquidity provider is a user who funds a liquidity pool with crypto assets she owns to facilitate trading on the platform and earn passive income on her deposit.Now liquidity providers have a unique chance to get significant amounts of LP tokens even with modest investments. The platform was recently launched and is increasing in volume every day.

- The investments are safe as DeFi AMMOB blockchain protocol guarantee that all the invested assets can be claim at any time.

How much liquidity providers are paid is based on the percentage of the liquidity pool that they provide. When funding the pool, they are usually required to fund two different assets to enable traders to switch between one to the other by trading them in pairs.

Profit Opportunities Unique to On-Chain Market Making with Order Book

AMMOB Market Making refers to providing liquidity on BitShares blockchain, which means that the token price quoting, order matching, and trade settlement all happens directly on the blockchain itself.- The XBTS DeFi AMMOB goal is to make it much easier and faster to onboard market makers to on-chain market making, provide all the tooling, education, and support they need.

The XBTS Dex BitShares-based on-chain DeFi AMMOB model has the following benefits:

Transaction speed: BitShares’ blockchain offers transaction speeds of less than 3 seconds to conclude.

Decentralization: The BitShares blockchain is fully decentralized which ensures users are protected. Hacking is impossible.

Low transaction costs: BitShares offers special solutions that make transactions in the system very cheap.It is a very easy to get acquainted with XBTS DEX.

Just visit https://app.xbts.io/ and start trading, investing into liquidity pools and staking assets in a few clicks.

Investing in DeFi AMMOB Pools - Step by Step Guide

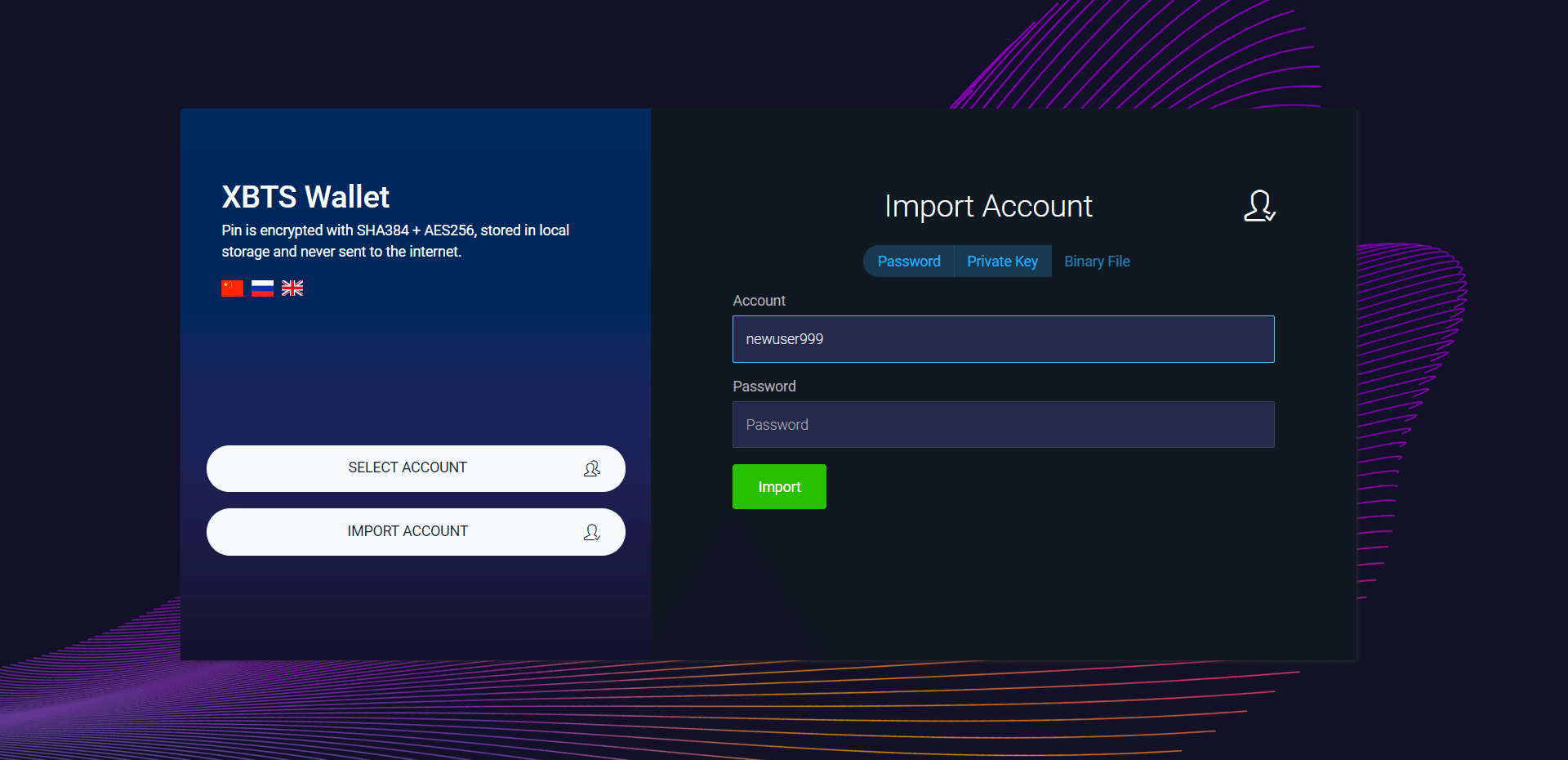

Step 1: Open XBTS DeFi Wallet web APP and register or import your account.

The exchange runs on the BitShares blockchain, so you can import your XBTS https://xbts.io or BitShares account. Only you have access to your account. The app does not store your data. XBTS DeFi Wallet is a Progressive Apps. We used modern APIs along with traditional progressive enhancement strategy to create cross-platform Web/ Online/Desktop XBTS DeFi Wallet.

The XBTS DeFi Wallet never holds or has any access to your funds — you are in total control of your private keys.

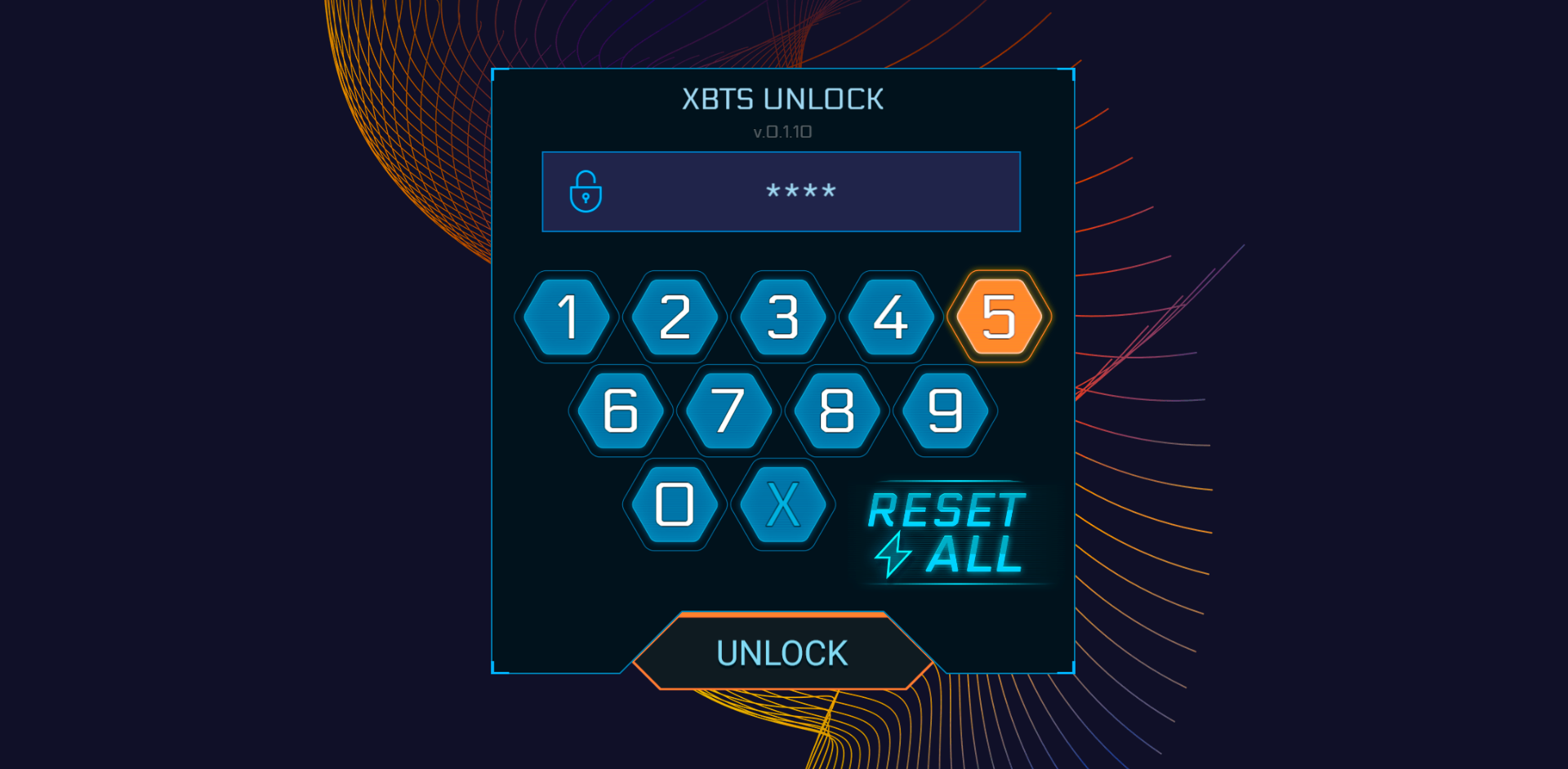

Pin-code

We built the Pin-code system that stops any form of data sniffing or keyloggers. The Pin-code is built into the XBTS DeFi wallet itself with ability to custom selected Pin-code for the ultimate level of wallet protection. The Pin-code is converted to a SHA-384 hash and encrypts itself using AES algorithms.

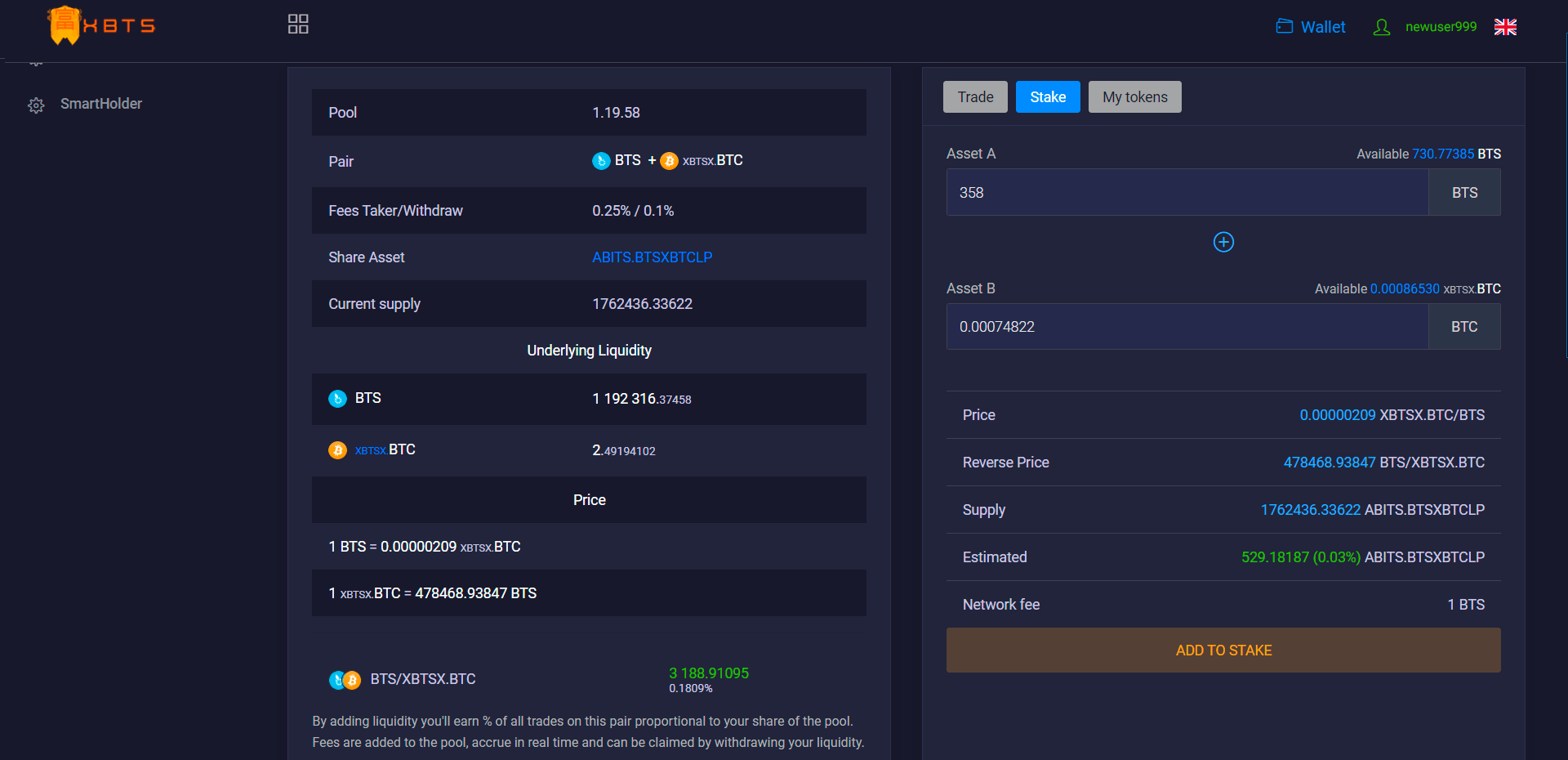

Step 2: Go to the “DeFi AMMOB” section.

The list of pools is displayed on the Defi AMMOB page. The list of pools presented in this section work according to the AMMOB protocol. The application displays a whitelist of pools.

Step 3: Select a pool.

You can select any pool you want.

Step 4: Press “Stake” button.

-

You can specify the amount you want to add to the pool. The system automatically calculates how many A and B tokens are needed.

-

You need to only enter one value, the second will be automatically calculated based on the current pool ratio

-

You can pre-calculate how much you need to deposit in order to get the desired percentage. To start participating in the pool and becoming a liquidity provider - Click "Add to Stake".

-

In the application, you can see the last operations that took place in the pool. Every swap transaction or adding/withdraw liquidity, is recorded on the BitShares blockchain and can be tracked in the Block Explorer.

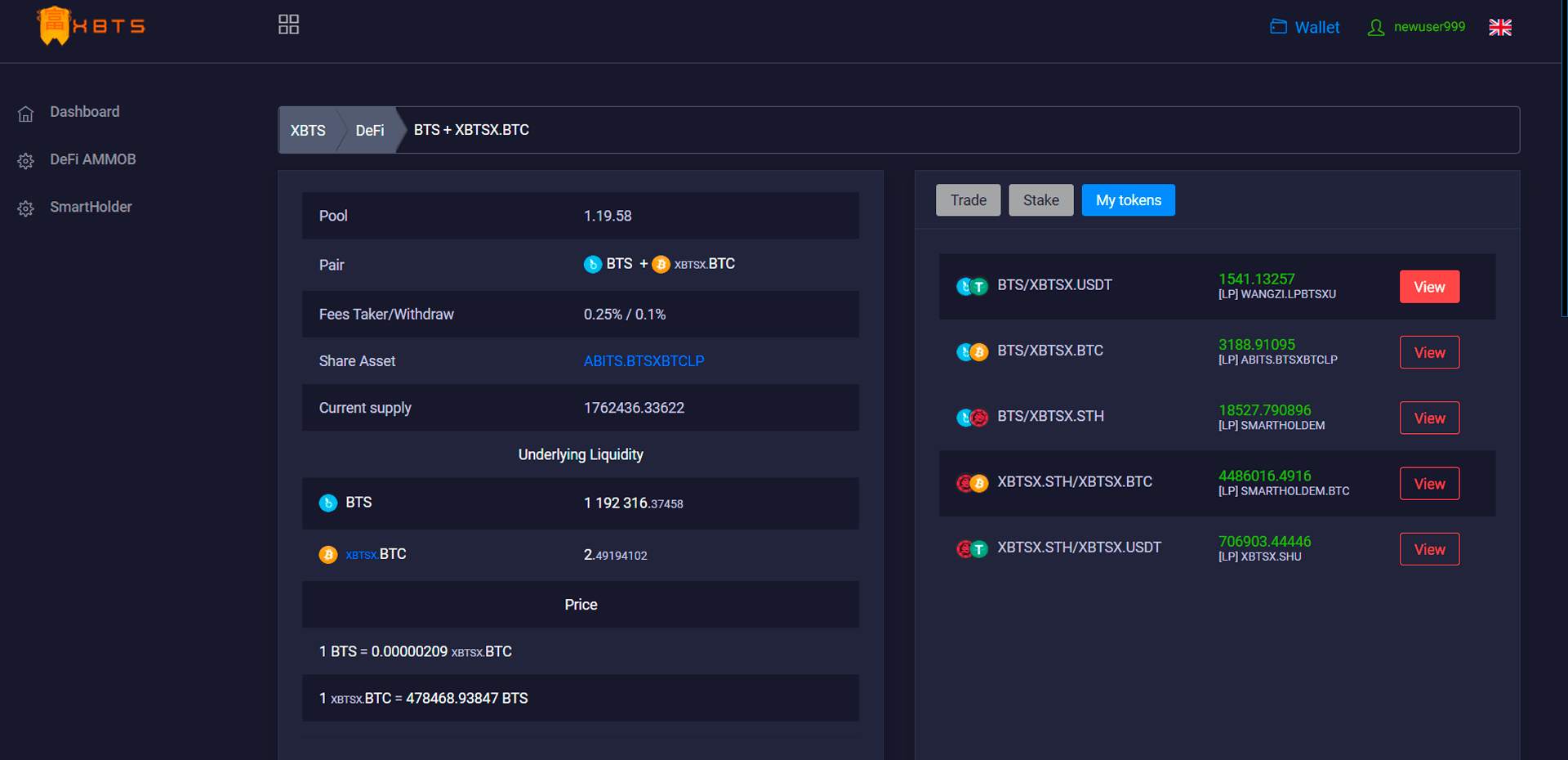

Step 5: Go to the "My Tokens" section

Your Stake in various liquidity pools and the amount of LP tokens in each pool are displayed here.

- Click to view the selected pool.

- You can calculate your share and claim tokens at any time.

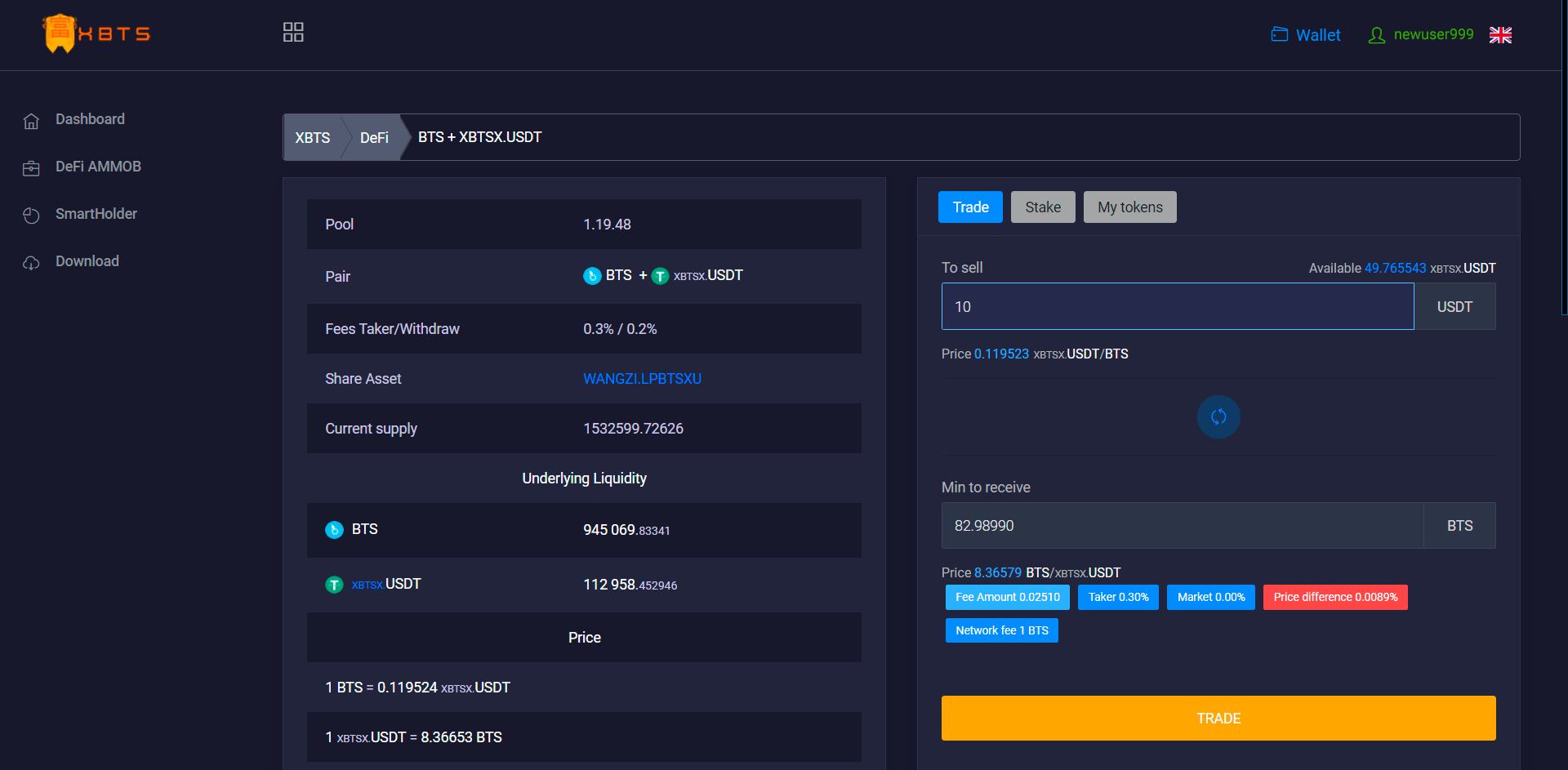

Step 6: Trade section

Here you can buy, sell, exchange the selected asset.

It is a fast way to swap cryptocurrency at market price.

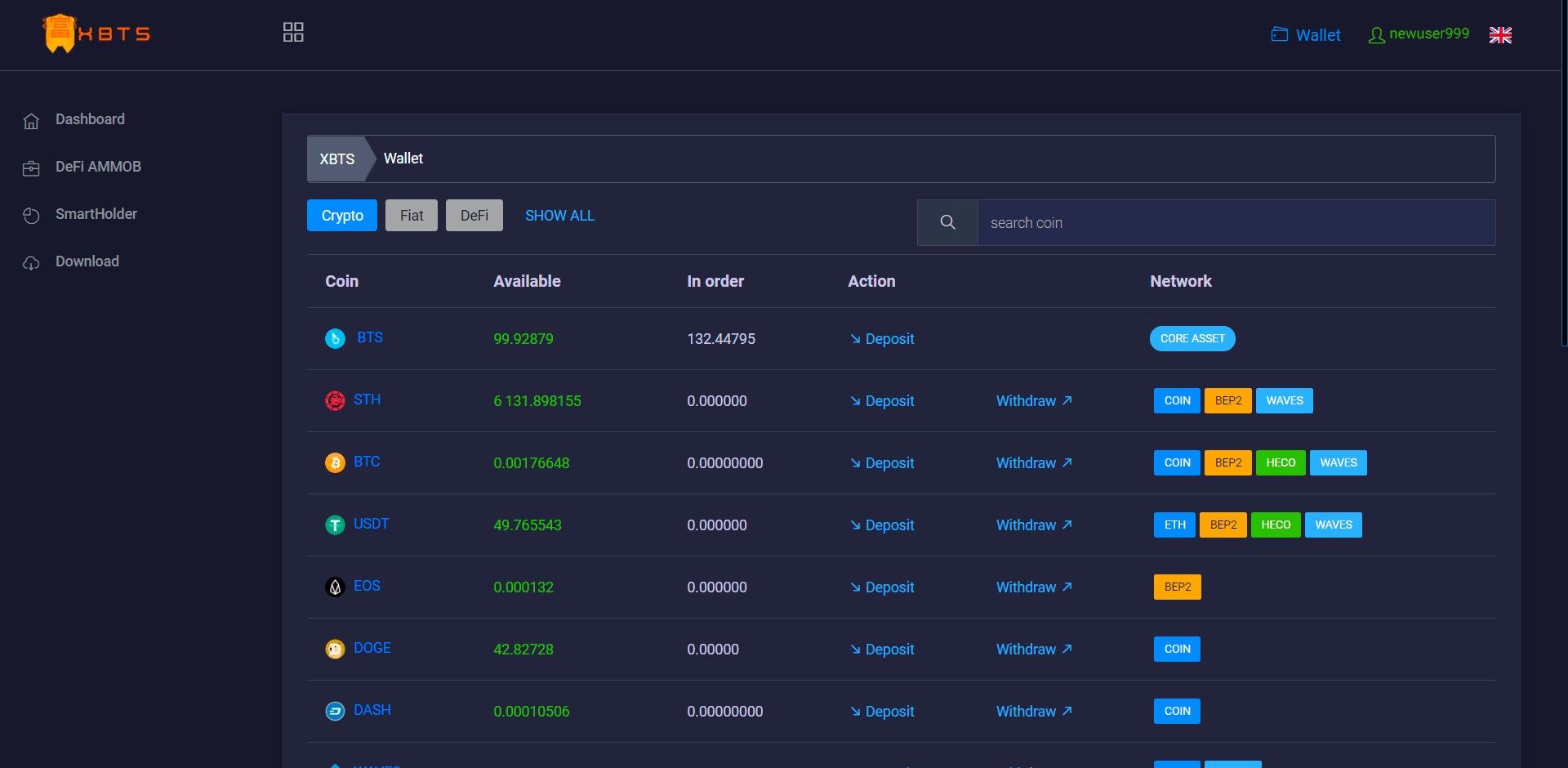

Step 7: Wallet

The wallet section displays all the assets that are on your balance.

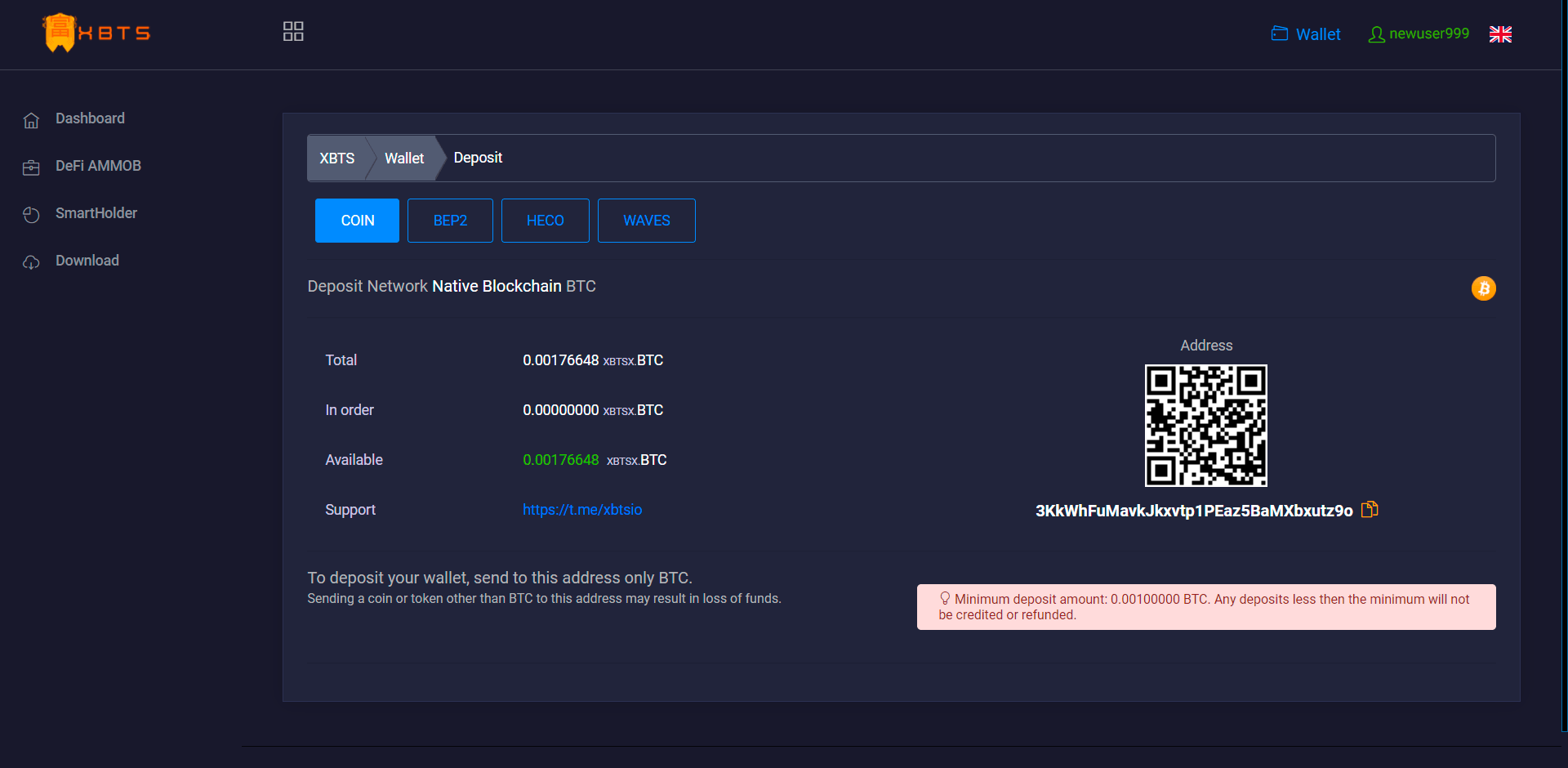

Step 8: Deposit/Withdraw

You can make a Deposit or Withdrawal of any asset by clicking Deposit or Withdraw.The XBTS exchange supports the Deposit and Withdrawal on native blockchains of coins as well as cross-chain bridges with other exchange blockchains: Binance Chain BEP2, Huobi Eco Chain HECO, Waves blockchain, Ethereum blockchain.

- Just select the blockchain through which you want to make a Deposit or Withdrawal.

- Different blockchains have different fees.

XBTS DeFi AMMOB https://app.xbts.io/

XBTS Decentralized Exchange https://xbts.ioFollow us on social media to stay up to date!

Twitter: https://twitter.com/XBTS_EXCHANGE

Telegram: https://t.me/xbtsio

Github: https://github.com/XBTS

Hive: https://hive.blog/@xbts

Instagram: https://www.instagram.com/xbtsdex/

LinkedIn: https://www.linkedin.com/in/xbtsdexteam/

BitcoinTalk: https://bitcointalk.org/index.php?topic=4810122

BitsharesTalk: https://bitsharestalk.org/index.php?topic=26813.0Disclaimer. XBTS DeFi AMMOB is a technical platform based on public AMMOB code on BitShares Splash 5.0 release that implement an automatic market maker order book algorithm for exchanging digital assets. Trading and investment decisions are made at the risk of platform users.

-